Get the free pdffiller

Show details

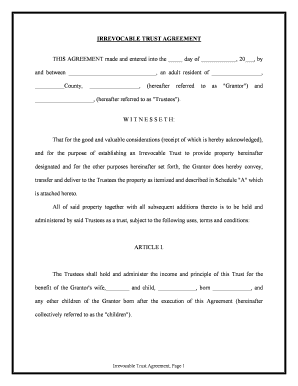

IRREVOCABLE TRUST AGREEMENT Intended to be completed gift and excluded from gross estate THIS AGREEMENT made this day of 20 between TRUSTOR S NAME of County State of hereafter called Trustor and WILMINGTON TRUST COMPANY a Delaware corporation WHEREAS Trustor desires to establish a trust of the property described in the attached Schedule A and other property which may be added from time to time all of which is WHEREAS Trustee accepts such trust a...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign irrevocable trust template form

Edit your irrevocable trust forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your sample irrevocable trust form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing create irrevocable trust online online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit irrevocable living trust form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out printable irrevocable trust form

How to fill out an irrevocable trust template?

01

Begin by gathering all necessary information, such as the names and contact details of the trust creator (grantor), trustee(s), and beneficiaries.

02

Carefully read through the template to understand its sections and requirements.

03

Start by filling out the introductory section, which typically includes the title and purpose of the trust, as well as the date it is being created.

04

Proceed to complete the grantor section, providing the grantor's name, address, and any specific instructions or limitations they wish to impose on the trust.

05

Move on to the trustee section, where you will detail the name, address, and contact information of the trustee(s) responsible for managing the trust assets.

06

Next, fill in the beneficiary section, specifying the names and relevant information of all beneficiaries who are entitled to receive the trust's assets or benefits.

07

If the trust involves specific assets or properties, include a detailed inventory of these assets in the designated section.

08

Consider including any additional provisions or conditions that align with the grantor's intentions, such as instructions for distributing assets, guidelines for trustee compensation, or special conditions for the trust's termination.

09

Once the form has been completed, review it carefully to ensure accuracy, clarity, and coherence. Seek legal counsel if necessary.

10

Have all required parties sign and date the trust document, ensuring that each signature is notarized if required by your jurisdiction.

11

Make copies of the completed trust document and store them in a safe place, while providing a copy to all relevant parties.

Who needs an irrevocable trust template?

01

Individuals who wish to protect their assets from potential creditors or legal claims may need an irrevocable trust template.

02

Those who wish to minimize estate taxes and ensure the smooth transfer of assets to their designated beneficiaries may also benefit from an irrevocable trust.

03

Families with beneficiaries who may not yet possess the financial maturity or responsibility to manage a large inheritance may find an irrevocable trust useful.

04

Some business owners may use an irrevocable trust to transfer ownership or protect business interests in the event of their incapacity or passing.

05

Individuals who desire to provide for the financial needs of a disabled or special needs family member may consider setting up an irrevocable trust.

06

Those who wish to maintain privacy and avoid the probate process for their assets may opt for an irrevocable trust.

Fill

irrevocable trust form

: Try Risk Free

People Also Ask about printable irrevocable trust form pdf

What is the downside of an irrevocable trust?

The downside to irrevocable trusts is that you can't change them. And you can't act as your own trustee either. Once the trust is set up and the assets are transferred, you no longer have control over them, which can be a huge danger if you aren't confident about the reason you're setting up the trust to begin with.

What is the wording for an irrevocable trust?

The Trust Assets shall be held by the Trustee in trust solely for the benefit of the Holders, subject to the terms of this Trust Agreement. The trust created by this Trust Agreement shall be irrevocable and the Issuers shall not have the right to terminate its existence.

How do you write an irrevocable trust document?

Draft the written irrevocable trust agreement. Spell out which assets will be placed into the trust, name a trustee and beneficiaries, and outline the terms by which the trust assets will be distributed (how, when, to whom, etc.).

What are the three types of irrevocable trust?

Types of Irrevocable Trusts Irrevocable life insurance trust. Grantor-retained annuity trust (GRAT), spousal lifetime access trust (SLAT), and qualified personal residence trust (QPRT) (all types of lifetime gifting trusts)

Why would someone want an irrevocable trust?

The only three times you might want to consider creating an irrevocable trust is when you want to (1) minimize estate taxes, (2) become eligible for government programs, or (3) protect your assets from your creditors. If none of these situations applies, you should not have an irrevocable trust.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify irrevocable living trust template without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including irrevocable trust example, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I execute irrevocable trust forms pdf online?

pdfFiller has made it easy to fill out and sign irrevocable trust documents. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

How do I edit how to fill out an 08 straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing irrevocable trust pdf right away.

What is irrevocable trust forms?

Irrevocable trust forms are legal documents used to establish an irrevocable trust, which cannot be modified or terminated by the grantor after its creation.

Who is required to file irrevocable trust forms?

Typically, the trustee or the individual responsible for managing the trust is required to file irrevocable trust forms.

How to fill out irrevocable trust forms?

To fill out irrevocable trust forms, provide information such as the names of the grantor and trustee, the beneficiaries, trust assets, and any specific terms or conditions of the trust.

What is the purpose of irrevocable trust forms?

The purpose of irrevocable trust forms is to legally establish the trust and outline its terms, ensuring that the trust assets are managed according to the grantor's wishes.

What information must be reported on irrevocable trust forms?

Irrevocable trust forms must report information such as the trust's name, grantor's details, trustee's information, beneficiaries, assets placed in the trust, and any specific instructions regarding distributions.

Fill out your pdffiller form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Sample Irrevocable Trust Document is not the form you're looking for?Search for another form here.

Keywords relevant to online irrevocable trust

Related to irrevocable trust california form

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.